City of Tacoma Government Employee Long-Term Care Information

This web page pertains to City of Tacoma General Government and Tacoma Public Utility employees only. Citizens seeking information on this program should visit WA Cares Fund Website.

WA Cares Fund Overview

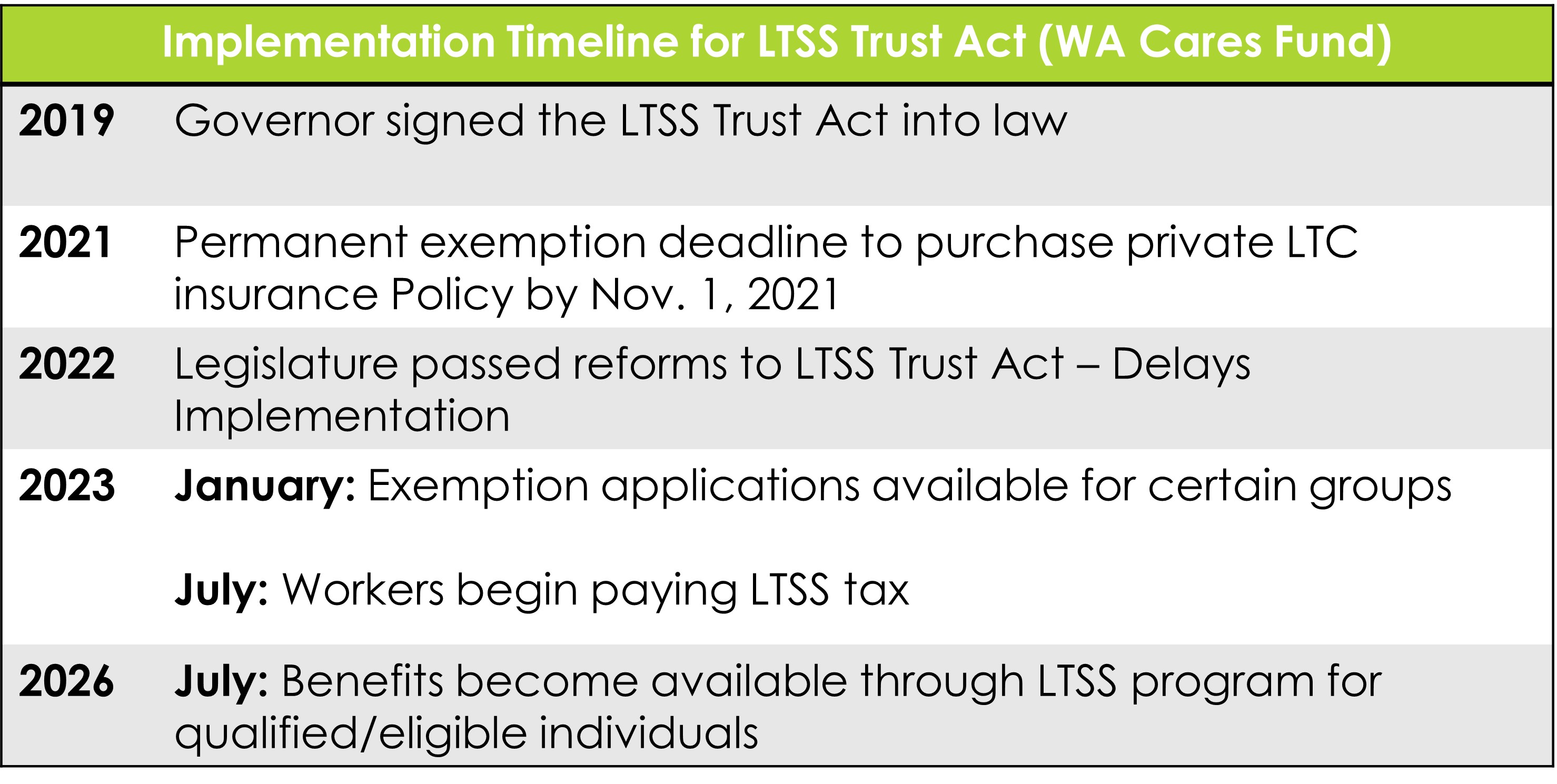

The WA Cares Fund is a mandatory long-term care insurance benefit established by Washington state law (Long-Term Services and Supports Trust Act) in 2019. The WA Cares Fund will be supported by a premium paid by employees only. Starting July 2026, these benefits may be used for a range of services, including professional care at home or at a licensed facility; training, pay and support for family members who provide care; memory care; home-delivered meals; rides to a health care provider; adaptive equipment and technology; home safety evaluation; and emergency alert devices.

WA Cares Mandatory Employee Payroll Deductions Begin for Paychecks on or After July 1, 2023

For City of Tacoma employees who have not opted out of the program, the first paycheck which will include the long-term care tax will be paid on Friday, July 7, 2023, which will include wages earned from June 19 - July 2, 2023

The premium has been set by state law at 0.58% of gross wages, or $0.58 per $100. For example, if an employee earns $50,000 annually, the total annual premium is $290, while an employee earning $150,000 would contribute $870 annually. Unlike other payroll taxes, there is no cap on the wages subject to this tax.

WA Cares Benefit Amount

Beginning in July 2026, eligible individuals who have vested in the program and have a need for long-term services and supports may begin applying for benefits. If eligible, and if the Department of Social and Health Services (DSHS) determines that an individual requires assistance with activities of daily living, the program provides benefits up to a maximum lifetime benefit of $36,500 with no daily limit (adjusted annually for inflation). Individuals born before January 1, 1968, can earn a partial benefit of 10% of the full benefit amount for each year they worked at least 500 hours.

WA Cares Program Eligibility

In order to be eligible for WA Cares Fund for full benefits, an individual must have worked and contributed to the fund for:

- A total of 10 years without an interruption of five or more consecutive years; or

- Three of the last six years at the time you apply for the WA Cares Fund benefit; and

- Worked at least 500 hours per year.

In order to be eligible for WA Cares Fund partial benefits, an individual must have been born before January 1, 1968 and worked and contributed to the fund for at least one year for 500 hours.

Additionally, to be eligible for benefits an individual must be at least 18 years old and a current resident of Washington.

Exemption Options for the WA Cares Program

Private Insurance Exemption

Individuals who had private long-term care insurance on or before November 1, 2021, were able to apply for an exemption from the WA Cares Fund from October 1, 2021, until December 31, 2022. This opt-out provision is no longer available. (See below for limited new exemption options available January 1, 2023.)

Note: Any exemption approved by the State for the private insurance exemption is permanent, and individuals may never opt back into the State program under the current legislation.

New Exemption Options Available as of January 1, 2023

Certain workers who would unlikely qualify or use their benefits can request an exemption beginning on January 1, 2023, and will be ongoing:

To opt out of the State’s long-term care program, individuals must apply for an exemption through the Employment Security Department (ESD) website wacaresfund.wa.gov. Visit the “Exemptions” section of the website and complete an Exemption Application. Individuals will need to verify their identity and establish a SecureAccess Washington (SAW) account. Individuals will also need to provide certain documentation to ESD when applying for an exemption based on the type of exemption they are applying for, which can be found here.

*Note: Workers with these exemptions will begin contributing to the State program if their situation changes and they no longer qualify for an exemption. They are required to notify their employer and ESD within 90 days of no longer qualifying. A discontinued exemption will take effect the quarter immediately following notification and premiums will be assessed. Employees who fail to provide notification will owe any unpaid premiums to ESD. Unpaid premiums will be assessed interest of one percent, compounded monthly, until payment is made in full.

Employee Notification Requirement

An employee who obtains an approved exemption from the ESD is required to provide written notification to all current and future employers of the exemption. ESD does not notify the City of your premium exemption. City employees must submit the exemption approval letter received from ESD to the City’s Benefits Office via email at benefits@cityoftacoma.org. If an employee fails to provide written notification of an approved, effective exemption to the Benefits Office, the City must collect and remit premiums to ESD.

More information

Visit the links under Employee Resources for more information.